Fifo Lifo or Average Cost Which Is Best

The journal entries for the above sales would be made as follows. The 100 shirts that we bought in the first purchase are still left at 10 each.

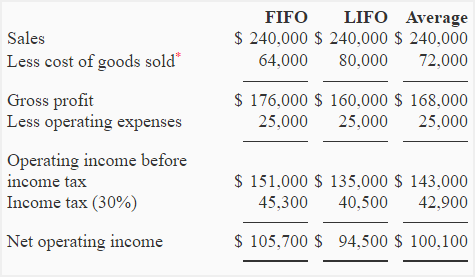

Exercise 11 Comparison Of Fifo Lifo And Average Costing Method Accounting For Management

This method is commonly used to determine a cost for units that are indistinguishable from one another and it is difficult to track the individual costs.

. The LIFO method for financial accounting may be used over FIFO when the cost of inventory is increasing perhaps due to inflation. 100 units at 5unit 500 in inventory. The Average Costing Method takes the last purchase of on-hand stock and any prior purchases in order until all quantities are accounted for.

LIFO and FIFO are the two most common techniques used in valuing the cost of goods sold and inventory. Through finding a balance between the two techniques the moving average price creates a stable method for financial reporting. Weighted average cost WAC inventory valuation.

As well the taxes a company will pay will be cheaper because they will be making less profit. Using FIFO means the cost of a sale will be higher because the more expensive items in inventory are being sold off first. In this inventory cost method the earliest manufactured or purchased goods are sold first.

To reiterate FIFO expenses the oldest inventories first. This strategy is related to the first in first out FIFO and last in first out LIFO methods which calculate the cost of goods sold and ending inventory based on stock movement. Which Inventory Valuation Method Is Best.

Such a system keeps up-to-date records of inventory balances. Weighted Average vs. The next month you buy another 300 chairs for.

The remaining unsold 150 would remain on the balance sheet as inventory at the cost of 700. You cannot use the moving average inventory method with a periodic. LIFO stands for Last-In First-Out.

Total cost of 16 units sold on January 14. This average cost is then posted when the item is sold. Furthermore since a corporation would make less profit.

Inventory is carried out at the market or lower cost. COGS 50 shirts x 20 LIFO cost 1000. No cost layering is needed as is required for the FIFO and LIFO methods.

Work and the financial differences between the two. This gives you a more accurate valuation of your current inventory. We also have 150 shirts from the second purchase at 20 each.

Choosing a Costing Method for COGS. Both the LIFO and FIFO methods fall in line with the Generally Accepted Accounting Principles GAAP GAAP GAAP Generally Accepted Accounting Principles is a recognized set of rules and procedures that govern. FIFO LIFO or Average Cost First In First Out FIFO Many large manufacturers regard this as the theoretically correct inventory valuation method.

FIFO stands for First In First Out. The moving average cost method is best used with a perpetual. Suppose you own a furniture store and you purchase 200 chairs for 10 per unit.

Exam Based Problems and Answers of FIFO and LIFO FIRST IN FIRST OUT FIFO Here Amount Rs Af Nu Rf ර Currency of your country PROBLEM. 4080 8400 12480. EP Flour Mills completes its final products through processes A B and C.

Proper guidance is provided on what specifically revenue is and how it should be measured. Average Costing is used to track inventory costing via average cost or by averaging the costs of all the quantities that are in stock divided by the total cost of those purchases. Because the more expensive items in inventory are sold off first the cost of a sale will be higher when using FIFO.

Inventory is carried at the net value that is realizable or lower cost. No clarity on how revenue should be timed or measured. The total cost of goods sold for the sale of 250 units would be 700.

When the cost of inventory is rising perhaps due to inflation the LIFO method of financial accounting may be preferred over FIFO. 8000 8160 16160. An online lifo fifo calculator allows you to calculate the remaining value of inventory and cost of goods sold by using the fifo and lifo method.

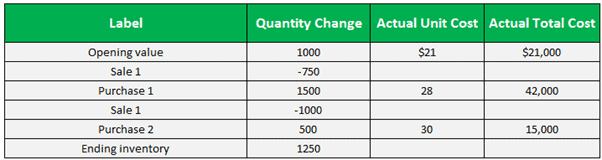

Remaining inventory value 100 shirts at 10 cost 150 shirts at 20 cost 4000. Total cost of 12 units sold on 23 January. In a period of inflation where the prices to purchase inventory increase over time you will be selling your least expensive inventories first using the FIFO method.

Since the moving average cost changes whenever there is a new purchase the method can only be used with a perpetual inventory tracking system. The product inventory management becomes easy with the assistance of this calculator for first-in-first-out and last-in-last-out. According to first-in first-out FIFO method the cost of 12 units sold on 23 January is computed below.

The E and PP use history cost for valuation. It asserts that the first materials and stock to come into inventory will be the first out when sold. 50 units at 4unit 200 in inventory.

For example say your business sells fabric. When prices are stable our bakery example from earlier would be able to produce all of its bread loaves at 1 and LIFO FIFO and average cost would give us a cost of 1 per loaf. Choosing the right inventory valuation method is important as it has a direct impact on.

Weighted Average Cost Per Unit Total Cost of Goods in Inventory Total Units in Inventory.

Fifo Vs Lifo Which Is Best Brightpearl

Inventory Methods For Ending Inventory Cost Of Goods Sold

Lifo Vs Fifo Inventory Valuation Explained

Fifo Lifo And Average Cost Inventory Calculations Multiple Sales Svtuition

0 Response to "Fifo Lifo or Average Cost Which Is Best"

Post a Comment